FOR IMMEDIATE RELEASE

DETROIT, JUNE 12, 2018 – Industry-leading payment acceptance solutions provider, International Bancard, has named Steve Merkouris as the company’s new Sales Director. Merkouris has more than 20 years of sales management experience, including over 10 years in the merchant services industry.

When you run and operate your own business, there is so much that you need to worry about and it can all be very overwhelming.

To add another layer of things, you also need to think about how you accept payments from your customers – credit cards, debit cards, cash, checks, mobile payments, and now digital gift cards? Where does it end?

Chances are, you have heard the phrase “FinTech” being thrown around – on television, in the news, or even in cities as additional businesses begin to open. FinTech is becoming so big that last year alone the industry has received $17.4 billion in investment globally.

But do you actually know what FinTech is and how it relates to you and your business?

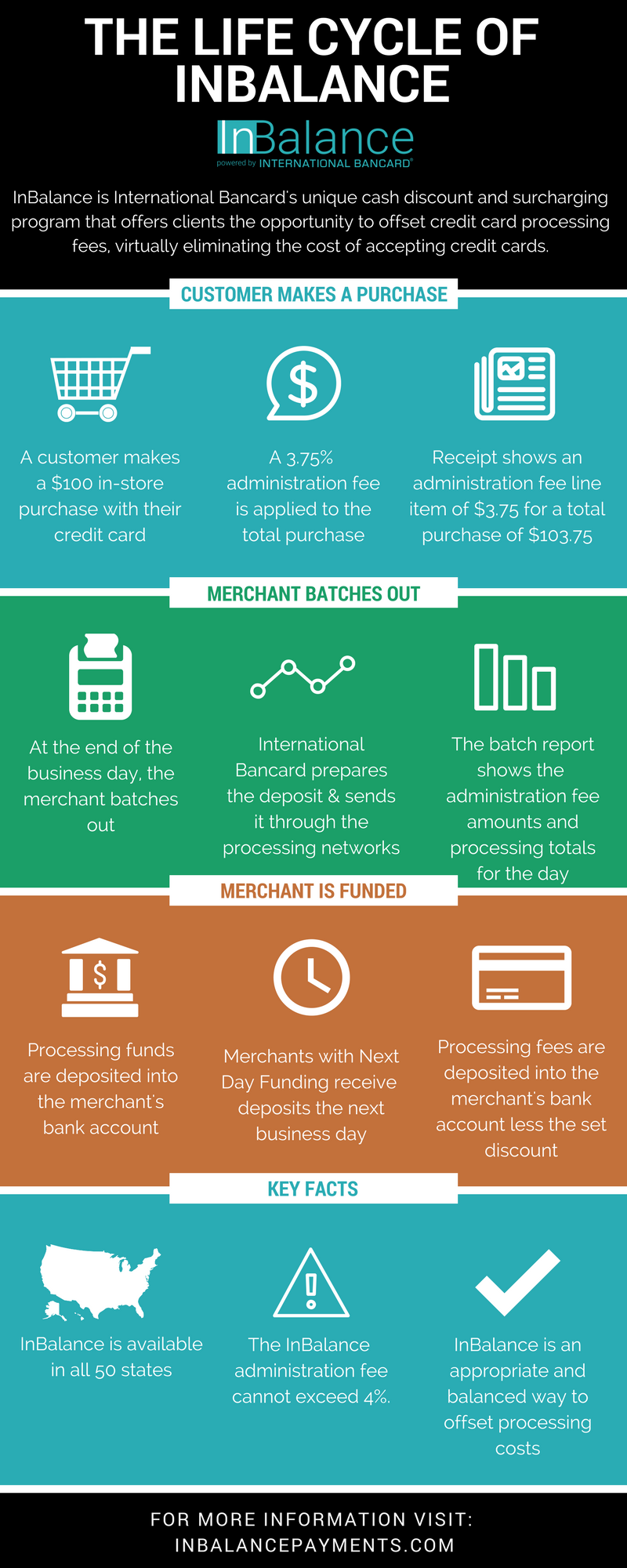

InBalance is International Bancard's unique cash discount and surcharging program that offers businesses the opportunity to offset credit card processing fees, virtually eliminating the cost of accepting credit cards.

When your business decides to accept credit cards, there is a lot of confusing language that you may have never heard of prior to dealing with a credit card processing company. Lucky for you, International Bancard deals with this language on a daily basis and we work with our clients to help them understand and become familiar with the industry lingo.

FOR IMMEDIATE RELEASE

As we make our way into 2018, new top trends in the payment acceptance industry are beginning to surface.

It's important for business owners to stay on top of these payment trends in order to accept payments the best way possible.

Here are International Bancard's top payment acceptance trends of 2018:

International Bancard knows that payment processing fees can be a trying word for merchants, which is why we created the InBalance program.

Fraud is something that merchants and consumers alike must be concerned with, especially since fraudulent activity continues to run rampant.

For many small businesses, much of their income for the year stems from just two months, November and December. According to the National Retail Federation holiday retail sales are expected to grow between 3.6 and 4 percent for 2017, for a total of $678.75 billion to $682 billion, which is up from $655.8 billion last year. If your payment processing system is not up to par, you could be missing out on your piece of the expected sales increase.