While lots of people prefer online shopping for many things, coffee shops still hold a place near and dear to a consumer’s heart. If you’ve been searching for a way to make sure your coffee shop remains an attractive option in today’s busy world, then you’ll be happy to learn that POS systems can do just that!

Quest Federal Credit Union has partnered with Detroit-based International Bancard to provide its members with a wide array of payment acceptance solutions.

The Best Business Tool You Can Invest In - Point Of Sales Systems (POS)

You’ve probably seen POS systems (point of sale) in chain retailers and restaurants. More and more small to medium sized businesses are investing in POS systems too, and with good reason. POS systems allow business owners to track sales, cash flow, inventory, and customer spend. Additionally, POS systems often have marketing and customer retention tools, like loyalty programs, built right in. POS systems help simplify bookkeeping and payroll by providing detailed reporting.

For many small businesses, much of their income for the year stems from just two months, November and December. According to the National Retail Federation holiday retail sales are expected to grow between 3.6 and 4 percent for 2017, for a total of $678.75 billion to $682 billion, which is up from $655.8 billion last year. If your payment processing system is not up to par, you could be missing out on your piece of the expected sales increase.

Nowadays, you would be hard pressed to find someone without a smartphone attached to their hands. It seems as if the technology has become an extension of ourselves, something that no one wants to go without. With the added convenience of smartphones and tablets have provided us, it’s no surprise that those have spilled over to the business realm!

As a business owner, you have a ton of responsibilities - making sure you have a great product to offer your customers, ensuring you have the right staff, abiding by rules and laws, marketing your business to new clientele, paying bills, and the list goes on and on.

Some of the trendier merchant services companies are popular with small business owners looking to accept credit card payments easily. It may be easy at first with the initial card reader you’re given. However, you are going to end up paying more in fees, and your equipment will most likely not be EMV-compliant, a big safety concern for your business.

Gift card programs are terrific tools to motivate customers to purchase your products and services. These programs are easy to maintain and keep your customers engaged and coming back to your business. Whether you have a retail store, a restaurant, or something in between, gift cards will help build your repeat customer base and attract new ones at the same time. The four biggest advantages your business will have by implementing a gift card program are:

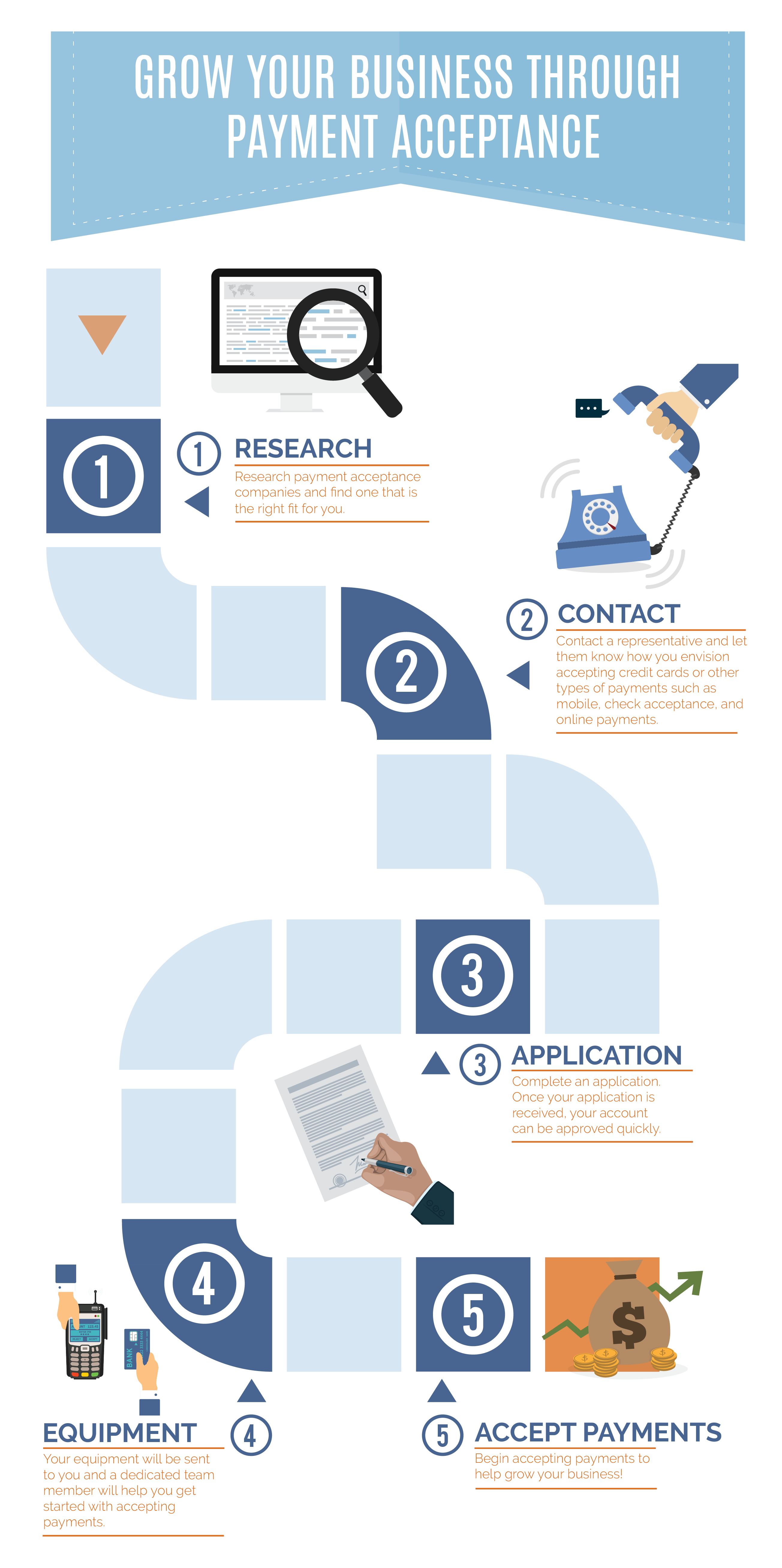

Starting a business can be overwhelming and confusing. Do you know the steps to take to help grow your business? If you’re looking to accept different types of payments to grow your business, it’s simple!

CLAWSON, Mich., January 14, 2015 — International Bancard, a nationally recognized leader in the payment acceptance industry, today announced an exclusive partnership with the Small Business Association of Michigan (SBAM). This partnership provides immediate benefits for SBAM and its members by giving them secure and convenient ways to accept credit, debit, ACH, check, and gift card payments, and by helping them identify new ways to drive business growth through payment acceptance.

“Given SBAM’s history, its dedication to Michigan’s entrepreneurs and small businesses, and its impressive advocacy initiatives, we’re proud to call SBAM a partner,” said David Iafrate, International Bancard CEO. “We have worked to develop exclusive opportunities to help the Association grow, improve its ability to assist its members, and help Michigan businesses focus on serving their own customers and growing their businesses, no matter what industry they’re in.”

Established in 1969, the Association serves more than 23,000 small-business members across all of Michigan’s 83 counties. SBAM’s mission is to help these businesses succeed by promoting entrepreneurship, leveraging buying power, and engaging in political advocacy. SBAM is headquartered in Lansing, just a block from the Michigan State Capitol.

“This partnership gives us a valuable new set of tools to offer our members, and it provides our organization with a real advantage,” said Rob Fowler, SBAM President and CEO. “Beyond all of the services we offer and the hard work we do for Michigan’s small businesses, we have one simple goal: Support our members in their drive for success, in this state and beyond. International Bancard has helped a long list of companies find a payment acceptance solution that helps them grow and give customers a memorable experience. Therefore, we believe our relationship with International Bancard will benefit our members in many innovative ways.”