Understanding the fees associated with accepting credit cards can seem confusing and overwhelming. However, they are pretty straightforward once you break them down. As a nationally recognized industry leader in credit card processing, International Bancard wants to help you learn about credit card processing fees. Not all credit card processing fees are negotiable, which is why it is important to understand what each fee is and how they work.

Recent Posts

Does your business accept payments online? Accepting online payments for a small business can help increase sales. You have many options for accepting online payments too, including accepting eChecks, recurring billing, online gateways and integrations, and more!

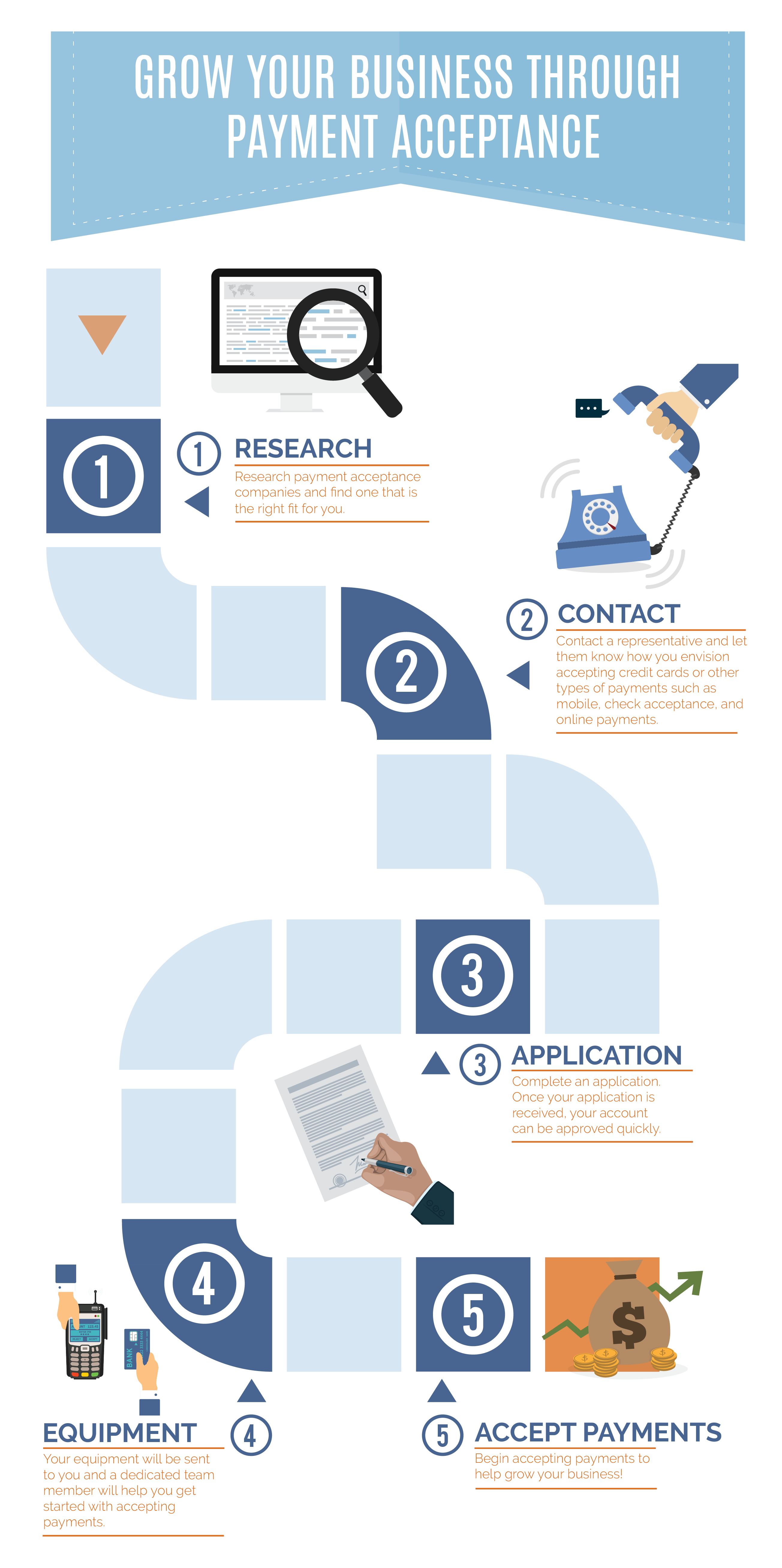

Starting a business can be overwhelming and confusing. Do you know the steps to take to help grow your business? If you’re looking to accept different types of payments to grow your business, it’s simple!

1505 Woodward to be renamed the ‘International Bancard’ building

By now, you have probably heard the buzzwords “EMV”, “chip cards”, or Fraud Liability Shift”, but do you really know what they mean? As a business owner, it’s critical for you to understand the importance of accepting EMV chip-enabled credit and debit cards. We have put together the top reasons why International Bancard feels all businesses should be accepting EMV chip cards and will help you understand the significance of EMV when it comes to your business.

Clawson, Mich., February 03, 2016 — International Bancard, an industry-leading credit card processing and payment acceptance solution provider, announced today that they are working with the Michigan Lottery to deploy a new payment solution to select Lottery retailers for the acceptance of credit cards for Lottery sales.

This sweepstakes is designed to give local businesses a chance to become a proud partner of the Detroit Red Wings for remainder of 2015-16 season

International Bancard’s Property Payments platform enables convenient payment options for tenants and easy-to-use property management tools for owners

New downtown Detroit-based company to provide industry leading credit card processing services

CLAWSON, Mich., January 14, 2015 — International Bancard, a nationally recognized leader in the payment acceptance industry, today announced an exclusive partnership with the Small Business Association of Michigan (SBAM). This partnership provides immediate benefits for SBAM and its members by giving them secure and convenient ways to accept credit, debit, ACH, check, and gift card payments, and by helping them identify new ways to drive business growth through payment acceptance.

“Given SBAM’s history, its dedication to Michigan’s entrepreneurs and small businesses, and its impressive advocacy initiatives, we’re proud to call SBAM a partner,” said David Iafrate, International Bancard CEO. “We have worked to develop exclusive opportunities to help the Association grow, improve its ability to assist its members, and help Michigan businesses focus on serving their own customers and growing their businesses, no matter what industry they’re in.”

Established in 1969, the Association serves more than 23,000 small-business members across all of Michigan’s 83 counties. SBAM’s mission is to help these businesses succeed by promoting entrepreneurship, leveraging buying power, and engaging in political advocacy. SBAM is headquartered in Lansing, just a block from the Michigan State Capitol.

“This partnership gives us a valuable new set of tools to offer our members, and it provides our organization with a real advantage,” said Rob Fowler, SBAM President and CEO. “Beyond all of the services we offer and the hard work we do for Michigan’s small businesses, we have one simple goal: Support our members in their drive for success, in this state and beyond. International Bancard has helped a long list of companies find a payment acceptance solution that helps them grow and give customers a memorable experience. Therefore, we believe our relationship with International Bancard will benefit our members in many innovative ways.”